NATIONWIDE SERVICES |

What the experts are saying

The American Institute of Certified Public Accountants (AICPA) Says:

CPAs should routinely recommend that their clients or employers use cost segregation studies whenever the expenditures for a structure, including leasehold improvements, equal or exceed $750,000. (AICPA, Cost Segregation Applied)

The Internal Revenue Service (IRS) Says:

In a recent landmark decision, the Tax Court ruled that, to the extent tangible personal property is included in an acquisition or in overall costs, it should be treated as such for depreciation purposes. The court also decided that the rules for determining whether property qualifies as tangible personal property for purposes of ITC (under pre-1981 tax law) are also applicable to determining depreciation under current law. The Service acquiesced to the use of ITC rules for distinguishing 1245 property from 1250 property.

Based on these developments, the use of cost segregation studies will likely continue to increase. (IRS Audit Techniques Guide)

The Wall Street Journal Says:

"Cost segregation is a lucrative tax strategy that should be used in almost every major purchase of commercial real estate." (Wall Street Journal)

Case Studies

Ready to increase cash flow and save on taxes? Call now for a free analysis on your property (801) 764-9100

APARTMENT COMPLEX

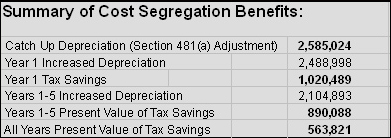

An owner purchased an apartment complex in the year 2000 for $8,000,000. For their 2006 taxes they did a cost segregation study. The following table shows the owner's benefits from doing a study.

By doing a cost segregation study the owner saved $1,020,489 in taxes in 2006!

INVESTMENT GROUP

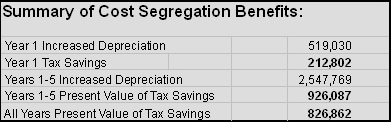

An Investment group constructed an office complex in 2007 for $19,000,000 and had a cost segregation study performed as soon as the building was completed. The following table shows their benefits.

SOLD PROPERTY

An building owner bought a retail complex in 2000 for $4,000,000 and sold the property in 2007 for $5,000,000 they then had a cost segregation study performed for their 2007 tax year. The following table shows their benefits.

We have many more cases that we'd love to discuss with you! Let us see what a cost segregation study can do for you! (801) 764-9100

We are always available to discuss our services at your location or ours.

For more information please contact us.

11650 S. State St. Ste. 200

Draper, UT 84020 |

575 Anton Boulevard, Suite 300 Costa Mesa, CA 92626 |

Home | Common Questions | Our Experts | Case Studies | Contact Us |